Welcome To Law & Tax Foundation™

We Offer AI-Powered Business, Estate, Nonprofit, and Tax Education, Research, And Consulting Services

10,000+ Cases

We have represented over 10,000 cases in diverse business and legal industries in diverse roles and capacities.

$50m+ Education Grants

We have helped our nonprofit clients unlock over $50 million in grants and funding from various sources to empower society.

$5+ Billion In Assets

We have restructured, facilitated, and negotiated $5 billion worth of assets and intellectual property over two decades.

Welcome To Law & Tax Foundation

We Help People Connect The Law, Tax, And Finance Dots With The Help Of Cutting-Edge AI Legal & Tax Tools

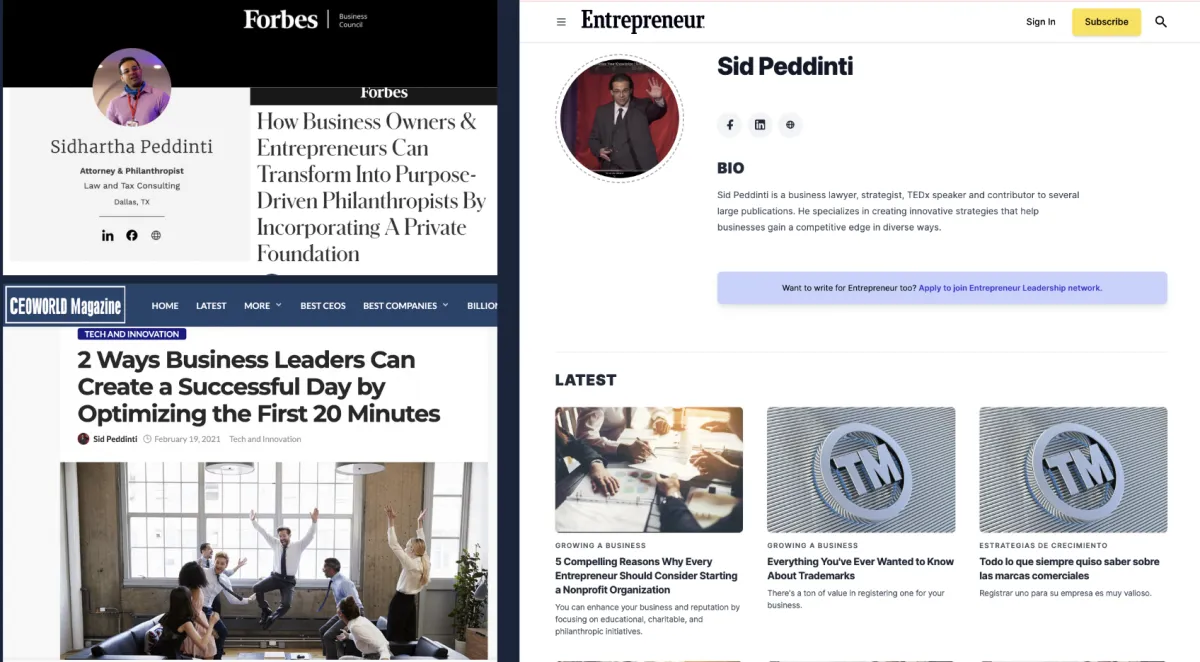

It's Sidhartha "Sid" Peddinti here.

My mission is to empower people through "law, technology, and philanthropy".

My legal entities were pierced in 2005.

My banks pulled the plug and forced me into the ground.

They seized my assets and flushed me clean.

I filed for a million-dollar bankruptcy at the age of 22.

Then my grandfather died and left us a probate time bomb.

That lasted all through law school.

We watched 60% of his estate destroyed by taxes and fees.

I've lost millions in revenue due to copycats stealing my IP.

I've also lost millions due to poor decisions and outright scams in the investment world.

I’ve even survived snake bites, stingray attacks, house fires, earthquakes, and tornadoes.

Those experiences didn’t break me - they awakened me.

They turned me into a philosopher of life, a legal and tax architect, and a relentless truth seeker.

🧠 What You’ll Find Here

This site is your gateway into a world of decoded legal and tax truths, where we unpack what most professionals don’t tell you - or don’t understand themselves.

I went bankrupt despite having the top lawyers, accountants, financial advisors, insurance agents, and realtors on my team.

My grandfather's estate went into probate despite having a will, trust, POA, and all sorts of insurance policies.

The truth is that, despite having all the top experts on your team, a little oversight, poor communication among your advisory teams, and inadequate legal or tax knowledge can destroy all your plans and send you to probate anyway.

You’ll find:

Case law, IRS codes, and hidden traps most planners miss

Advanced research, strategic hacks, and implementation roadmaps

A library of videos, blogs, tools, publications, and in-depth courses

Real-world examples of structures that failed — and how to fix them

🤖 And Yes — We Use AI. A Lot.

Since 2014, I’ve been building AI tools and legal tech apps:

One measured referral ROI metrics for ecommerce firms

One created smart operating agreements for tech firms

One digitized thousands of Fortune 500 entertainment contracts

One built and digitized educational nonprofits during COVID and unlocked $50+ million in funding

And now, the one that blends them all:

The Mythbuster AI™: An AI assistant trained on business and estate law, tax code, estate traps, insurance myths, and legacy strategy (over 10,000 cases, publications, codes, and applications trained and processed).

📍This isn’t theory.

It’s a culmination of pain, research, rebuilding, and innovation.

Explore the site.

Watch the videos.

Use the tools.

And protect what you’ve built - before it’s too late.

Talk soon,

Sidhartha, Esq.

BA, BIA, LLB/JD, LLM

Upcoming Events

Our affiliate courses are designed by experts who have years of experience and proven results in the affiliate marketing industry.

6. Fueling Change: Lifetime Funding and Tax-Free Investing for Nonprofits

One of the biggest challenges that nonprofits face is securing sustainable funding. While donations, grants, and fundraising events are crucial for day-to-day operations, these sources may not always provide the consistent, long-term financial stability that a nonprofit needs to thrive. This is where strategic investment planning becomes an invaluable tool. By strategically investing their assets, nonprofits and private foundations can create an endowment that funds their mission indefinitely, ensuring they can continue to serve their cause year after year, regardless of fluctuations in donation levels.

A prime example of how this can work is Harvard University's massive endowment, which exceeds $50 billion. The university's investment strategy is designed to generate a consistent income stream to support scholarships, research, faculty positions, and the overall operations of the institution—without depleting the principal. The funds are carefully managed and strategically allocated across various investments, from stocks and bonds to private equity and real estate, ensuring that the endowment continues to grow while also producing income for immediate needs. While not every nonprofit can match the scale of Harvard’s endowment, the fundamental principle is the same: by investing strategically, a nonprofit can establish a sustainable, self-sustaining funding model that powers its mission.

The Internal Revenue Code provides a framework for nonprofits and private foundations to benefit from strategic investing. For example, IRC §4940 governs the taxation of investment income for private foundations. While private foundations are generally tax-exempt, they are subject to a modest excise tax (currently set at 1.39%) on their net investment income. This tax is designed to encourage responsible investing and prevent foundations from hoarding wealth without contributing to their charitable mission. By paying this small tax, foundations are incentivized to actively invest their assets in ways that generate long-term growth while maintaining compliance with the law.

For your nonprofit, this strategy could be the key to creating a perpetual funding stream that allows you to focus on fulfilling your mission without worrying about financial shortfalls. Whether you're working on a local project or supporting a global cause, having an endowment that generates income could provide the financial security you need to plan for the future. By combining tax-free investing with strategic asset management, you can build a resilient foundation for the long-term sustainability of your organization.

Have you considered how tax-free investing could support the future of your nonprofit? If you haven’t yet explored this avenue, now might be the perfect time to start thinking about ways to ensure that your mission can continue to grow and evolve, regardless of economic shifts or changes in funding availability. Strategic investing not only helps secure financial independence but also empowers nonprofits to adapt, innovate, and expand their impact over time.