Thrive Through Philanthropy

Discover How Nonprofits and Foundations Can Be Leveraged To Protect Your Assets, Safeguard Your Intellectual Property, Lower Risks, Boost Your Brand, Preserve Wealth, And Reduce Multiple Layers Of Taxes And Court Fees

10,000+ Cases

We have represented over 10,000 cases in diverse business and legal industries in diverse roles and capacities.

$50m+ Education Grants

We have helped our clients unlock over $50 million in grants and funding from various corporations to advance education.

$2 Billion In Assets

We have helped our clients protect billions of dollars worth of business assets, intellectual property, and personal assets.

Welcome To Law & Tax Consulting

Law & Tax Consulting Is A Research, Training, and Consulting Firm That Specializes In Conducting Research, Advancing Legal Education, and Encouraging People To Become Philanthropists

It's Sidhartha "Sid" Peddinti here.

My mission is to empower people through "law, technology, and philanthropy".

I've been bankrupt.

I've been copied and my ideas have been stolen.

I've been scammed by a lot of companies.

I've lost a lot of "time, talent, and treasure" pursing the wrong things.

I've been brainwashed by the media and chased a lot of "shiny objects".

And - I finally snapped out it of one day, roughly 18 years ago.

Since then, my mission has been to conduct research, verify all claims, and question every "pitch" being made by the gurus out there.

Two law degrees, multiple business, technology, tax, and nonprofit certifications, 25+ business ventures, 20,000+ hours of legal and tax research, 100+ keynotes and training sessions, 1,000+ program graduates, and 10,000+ client consultants later - we discovered that "nonprofits and foundations" hold the key to unlocking all our dreams, goals, and bottom-line, across all fronts: business, personal, and legacy related.

Everything we offer incorporates the strategic use of philanthropy. I share my research and insights through courses, programs, keynotes, articles, and educational movements.

I look forward to speaking with you, learning about you business, understanding your family's multi-generational goals, and help you thrive on all fronts by becoming a philanthropist.

Talk soon,

Sid Peddinti, Esq.

BA, BIA, LLB/JD, LLM

Practical Case Studies

Profile: Business Owners And Investors.

8+ Figures In Present & Future Tax Savings.

We are collaborating with the owners of a consulting firm who plan to exit their business within the next two years and reinvest their profits across various asset categories.

They prefer to avoid a 1031 exchange in order to diversify their portfolio.

Our focus is on aligning their corporations, wills, revocable trusts, irrevocable trusts, and foundations from a legal standpoint, while also coordinating various tax strategies to address both current and future tax obligations.

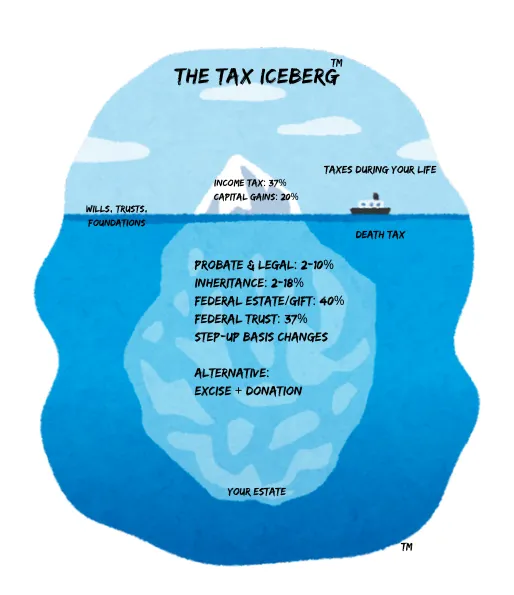

Here are a list of tax strategies that we look at:

- Reducing income taxes on the high AGI that they currently face

- Reducing or avoiding capital gains taxes on the business sale

- Avoiding or lowering federal trust and estate taxation

- Avoiding or lowering capital gains on other asset liquidations

- Avoiding or lowering Probate and legal costs

- Avoiding or lowering state inheritance and estate taxes

- Navigating the old vs new step-up basis rules and changes

We are helping them embrace a Mini Family Office™ approach, where their business advisory, tax, and finance teams are aligned and operating from the same playbook.

One of their main goals in life is to create a legacy that's deeply rooted in social and humanitarian contribution - their vision is to incorporate the philosophy encouraged by the tax code: Do Well By Doing Good In The World!

Profile: High-W2 Wage Earners And Investors

7+ Figures In Present & Future Tax Savings

We are working with a power couple in their 40s, a lawyer and an engineer, with high AGI, paying six-figures in income taxes annually. They have two children, ages 10 and 14, and several categories of assets and investments.

Their goals include:

- Reducing their annual tax burden

- Increasing their charitable contributions

- Enhancing their insurance coverage

- Creating trust funds for their children

- Diversifying their investment portfolio

They were referred to us by a joint venture partner, a seasoned Financial and Insurance Advisor at a large investment firm who has been working with the couple for a few years.

We are helping them establish a combination of entities, including a limited liability company (LLC), a revocable trust, a pour-over will, an irrevocable life insurance trust (ILIT), an irrevocable trust, and a private foundation.

Each entity serves a distinct purpose, but together they create a cohesive strategy. By restructuring their existing assets (stocks, funds, crypto, and real estate) into LLCs, trusts, and foundations, we aim to reduce their current tax burden by 30% annually, while formulating alternative methods to lower "future taxes and costs" as well.

This approach also provides greater control over their investments, minimizes personal risk, and allows them to utilize gifting laws to establish robust insurance policies for their children.

Mini Family Office: Strategic JV with a personal injury law firm

Integration with a personal injury law firm

Our Joint Venture Partner:

A personal injury lawyer representing a client with a large settlement ($40+ million).

Challenge:

The client was awarded a significant personal injury settlement, avoiding income tax on the injury portion.

However, punitive damages and emotional suffering awards were still taxable, and without proper planning, the client would have not only faced a large amount of income taxes in the year of the settlement, in addition to facing probate taxes, inheritance taxes, and federal estate or gift taxes which are taxed at 40%.

Solution:

We partnered with the personal injury lawyer to implement our Mini Family Office strategy, aligning legal, tax, and financial approaches.

We established a combination of trusts and private foundations to hold and invest the settlement funds, removing them from the client’s estate.

This not only shielded the punitive and emotional suffering damages from immediate taxation but also ensured that the settlement would not be subject to the 40% estate tax upon the client’s death. In addition, we engaged the client and his family members in the foundation and helped them get crystalize their long-term goals which involved philanthropic and charitable work.

Through the trust and foundation structures, the client was able to:

- Avoid future estate tax on the settlement, preserving more wealth for heirs.

- Protect the punitive damages and emotional suffering awards from additional taxation at the income tax level.

- Put the funds to investment use while maintaining long-term tax benefits.

- Crystalizing the investment plans of the family while getting reinvesting the settlement funds into income-producing assets.

The strategic move allowed the client to secure a tax-efficient future for their settlement, preserving their wealth and creating a lasting legacy, while allowing the personal injury lawyer to increase the value of their offerings, save the client even more money and funds, and help them beat future taxes and legal costs that are sure to arise.

Mini Family Office: Strategic JV with an insurance brokerage

Partnering with an Insurance and Financial Advisory Firm – Tax Mitigation and Estate Planning for High-Income Clients

We strategically integrated our estate and tax planning services with the services offered by an insurance and financial advisory firm that mainly serves entrepreneurs, lawyers, and high-income W2 earners.

Problems addressed:

The firm’s clients, many of whom were high-income earners, faced complex estate and tax planning challenges, including hidden taxes on the assets they hold and control, such as publicly traded stock, retirement accounts, mutual funds, equities and bonds, crypto, and insurance policies.

Without proper structuring, insurance proceeds and other assets would be included in the estate, increasing estate size and tax exposure at the time of the client's death. The firm needed a comprehensive approach to help clients protect their wealth and minimize tax liabilities, particularly for those with significant insurance policies and estate concerns - especially in light of the upcoming changes to the estate and tax laws in 2026.

Solutions offered:

We partnered with the firm to introduce our Mini Family Office strategy, providing in-depth training on estate and tax planning concepts. Through this collaboration, we:

- Introduced the Tax Iceberg Model: We helped the firm and their clients understand "hidden taxes," including estate, income, and inheritance taxes that can impact high-net-worth individuals.

- Structured Insurance Policies: We provided strategic guidance on structuring life insurance policies to ensure they were placed outside the estate, preventing the proceeds from being included in estate calculations and thus avoiding estate tax exposure.

- Estate and Tax Planning Training: We trained the firm’s advisors on essential estate planning techniques, including the use of trusts, private foundations, and tax-efficient structures, empowering them to offer high-value solutions to their clients.

Outcome:

By integrating our Mini Family Office model, the insurance and financial advisory firm saw substantial benefits for both their advisors and their clients:

- Reduced Estate Size: Properly structured insurance policies were moved outside the estate, eliminating the inclusion of proceeds in estate tax calculations.

- Tax Efficiency: Clients were able to avoid hidden taxes and significantly reduce their estate and inheritance tax liabilities.

- Increased Client Confidence: Advisors were equipped with new tools and knowledge to confidently guide clients through complex estate and tax planning decisions, strengthening client relationships.

- Expanded Service Offering: The firm now offers comprehensive estate planning services, enhancing their value to high-income clients and attracting new business.

This partnership empowered the firm to provide sophisticated estate planning and tax-saving strategies to high-net-worth individuals, ensuring long-term financial security and tax efficiency for their clients.

Upcoming Events

Our affiliate courses are designed by experts who have years of experience and proven results in the affiliate marketing industry.

6. Fueling Change: Lifetime Funding and Tax-Free Investing for Nonprofits

learn how to recycle your tax dollars towards more impactful investments ...more

Private foundations

January 14, 2025•2 min read

4: Charitable Tax Deductions: Unlocking Benefits for Individuals, Corporations, and Foundations

how to leverage nonprofits and foundations to extend and maximize the value, impact, and utility your dollar ...more

Private foundations

January 14, 2025•2 min read