Law And Tax™

Strategic Legal, Tax, and Capital Infrastructure

We design systems that align law, tax, finance, and capital - so growth, protection, and impact happen by design, not by accident.

The Tax Code Was Never Meant to Be Used in Pieces

Yet, most people are only using half the system.

Entrepreneurs, families, and even professionals tend to focus exclusively on taxable entities and transactions - business income, capital gains, wages, and exits.

What’s often ignored is the other half of the system:

tax-exempt entities, public benefit structures, and institutional capital pathways.

That imbalance leads to:

unnecessary tax exposure

missed capital opportunities

over-reliance on savings and debt

fragile long-term structures

The problem isn’t a lack of opportunity.

It’s a lack of structure.

We focus on legal, tax, and financial architecture - reinforced with the power of AI.

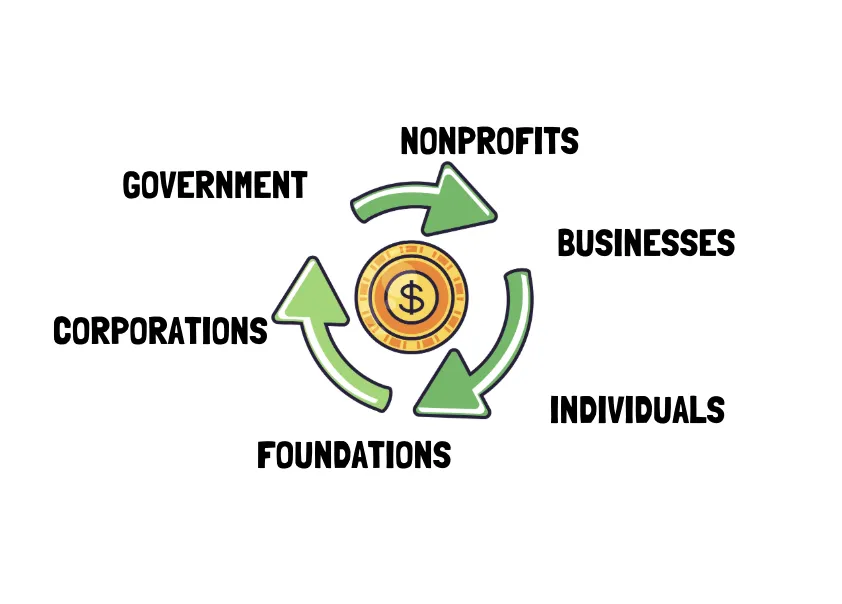

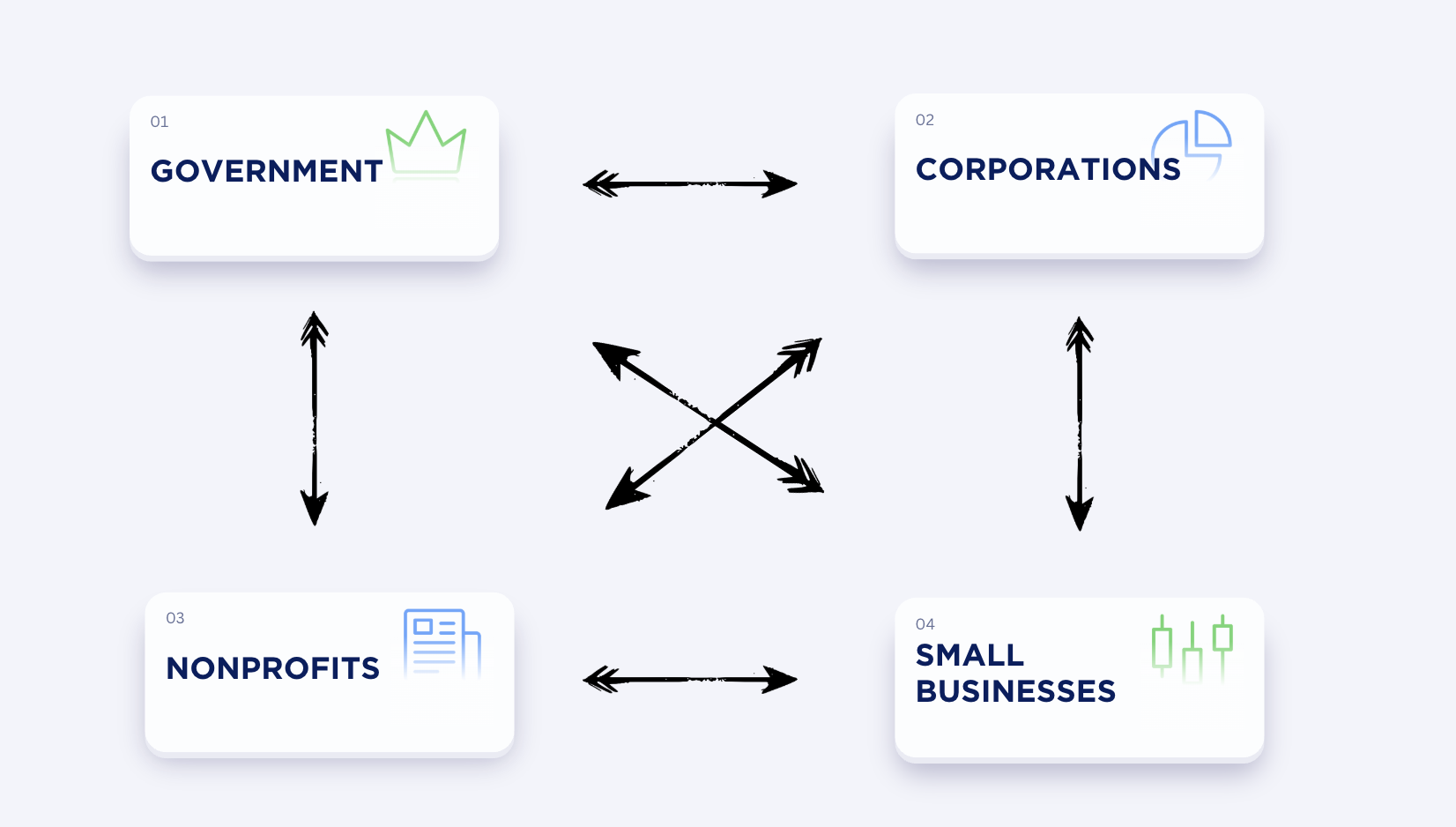

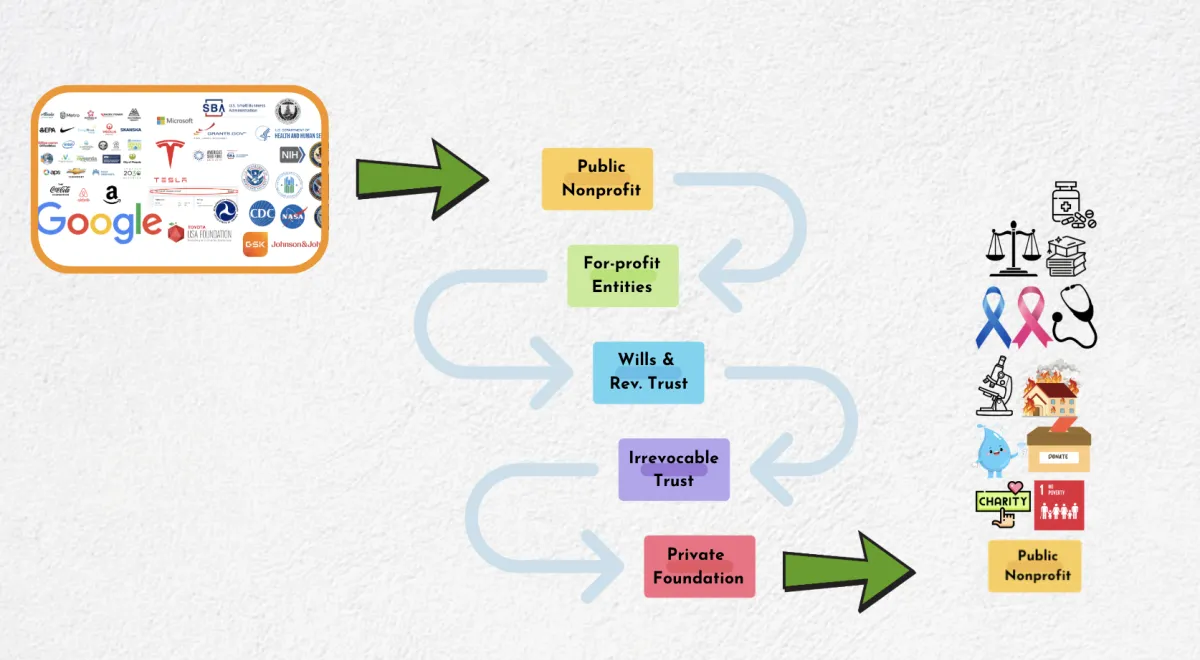

How Capital Actually Moves in the Economy

Recycled across several layers

People, businesses, nonprofits, and corporations all transact with each other.

Taxes apply at multiple levels: personal, business, and investment.

Assets and investments are taxed through sales, property, capital gains, and estate taxes.

Government collects taxes and reinvests them across the economy.

Government also buys, sells, funds, grants, and lends to businesses, nonprofits, and individuals.

Nonprofits drive education, research, innovation, and public service.

For-profit entities focus on commercialization, growth, and returns.

Private foundations help manage taxes and assets while funding nonprofit work.

When aligned properly, the system funds itself.

The issue is not capital scarcity.

It’s structural fragmentation.

We align the flow of social capital with the entities and missions that can deploy them responsibly.

This Is How the Most Successful Builders Have Always Operated

Do Well By Doing Good

A careful examination of the most successful companies, institutions, and long-term builders - industrial leaders, philanthropists, and modern enterprises - reveals a consistent pattern:

They never separated:

business strategy

estate and asset control

nonprofit and public benefit

tax and capital planning

They integrated them.

Not to avoid responsibility - but to scale impact, resilience, and influence. These structures were designed to work together.

This "strategic philanthropy" model was detailed by Andrew Carnegie in 1889, and later formalized into the tax code in 1917. Philanthropic work though your business, nonprofit, or foundations can benefit your family and humanity at the same time.

We architect the structures, concepts, and strategies, and align the professionals who can help our clients execute this model with success, generation after generation.

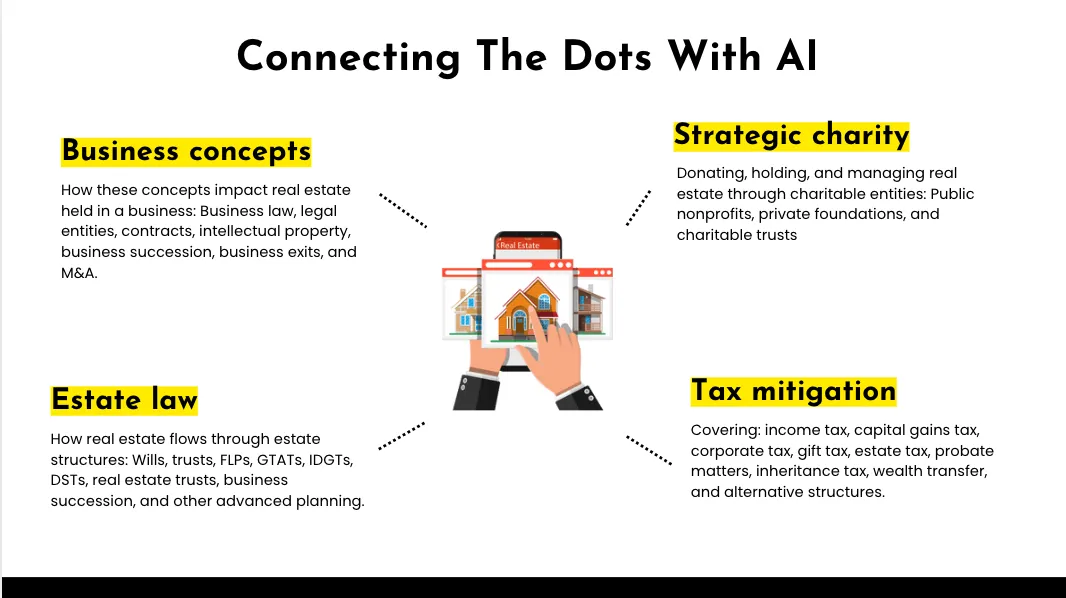

Our Operating Framework: BENT Law™

Every strategy follows one integrated legal architecture.

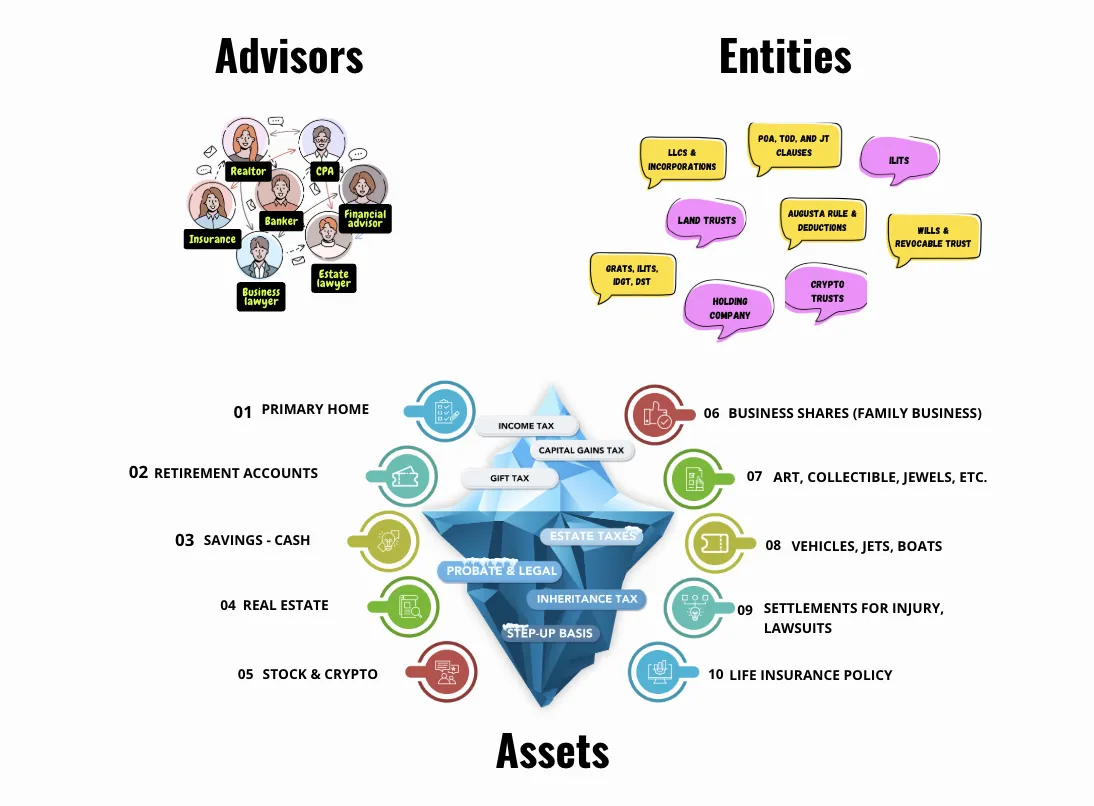

We apply the same structural logic - adapted for modern entrepreneurs, families, and institutions - through our proprietary BENT Law™ framework:

Business Law – "ARM Your Business™ (asset protection, tax mitigation, IP monetization)

Estate Law – Philanthropic Estate Planning™: Nonprofits & foundation integration

Nonprofits & Foundation Law – public benefit, foundations, institutional pathways

Tax Law – mitigation, compliance, long-term efficiency (Tax Iceberg™ Model)

This ensures decisions are aligned, defensible, and built to last.

Strategic Incubators & Pathways

Three Pieces Of The Same Puzzle.

Law & Tax Incubator™

Mini Family Office System™

Designed for individuals, professionals, entrepreneurs, investors, and advisory teams who need full-picture alignment.

Centralizes business, estate, nonprofit, and tax strategy

Identifies hidden taxes, probate traps, misaligned entities, and structural risk

Creates a single, coordinated roadmap across assets, teams, and goals

Available for direct clients or advisory teams installing the system via JV

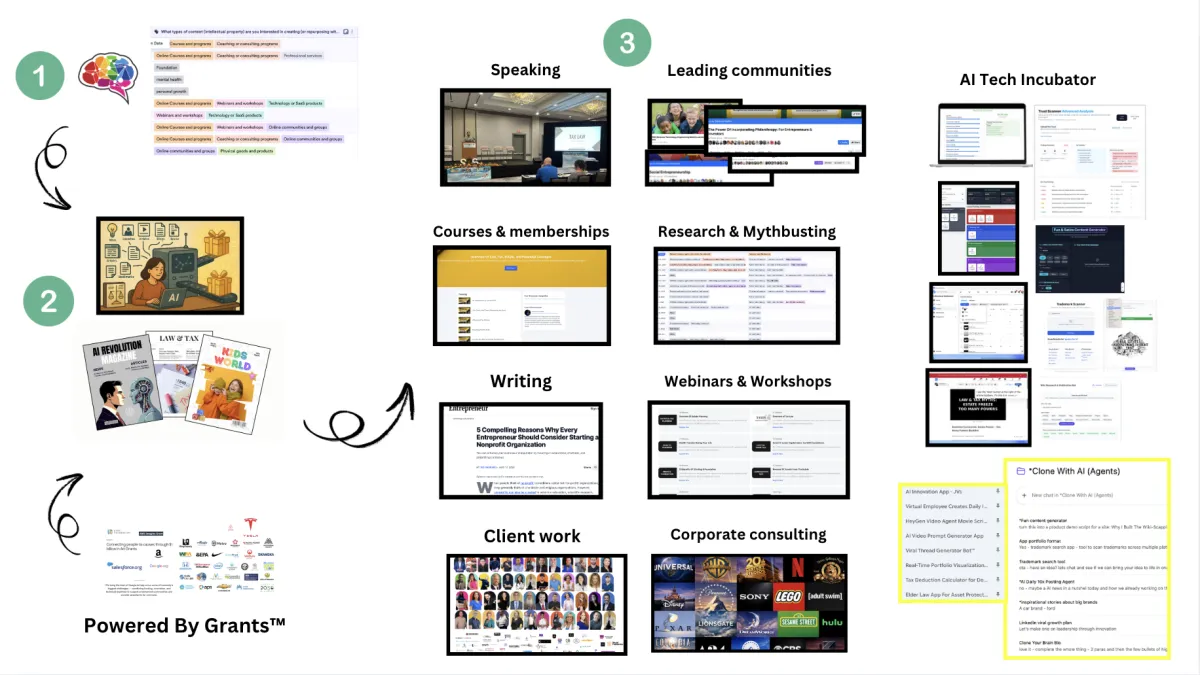

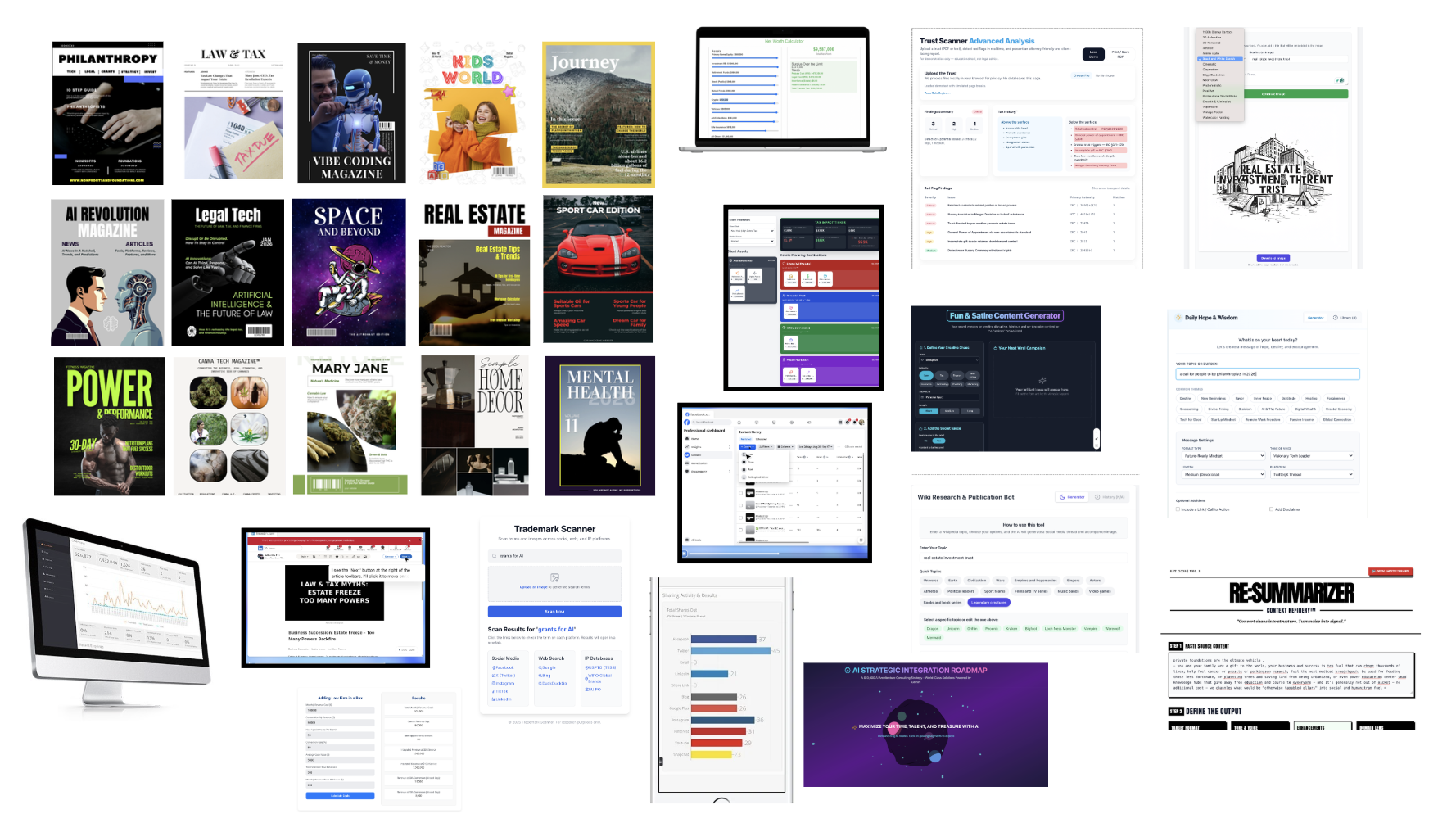

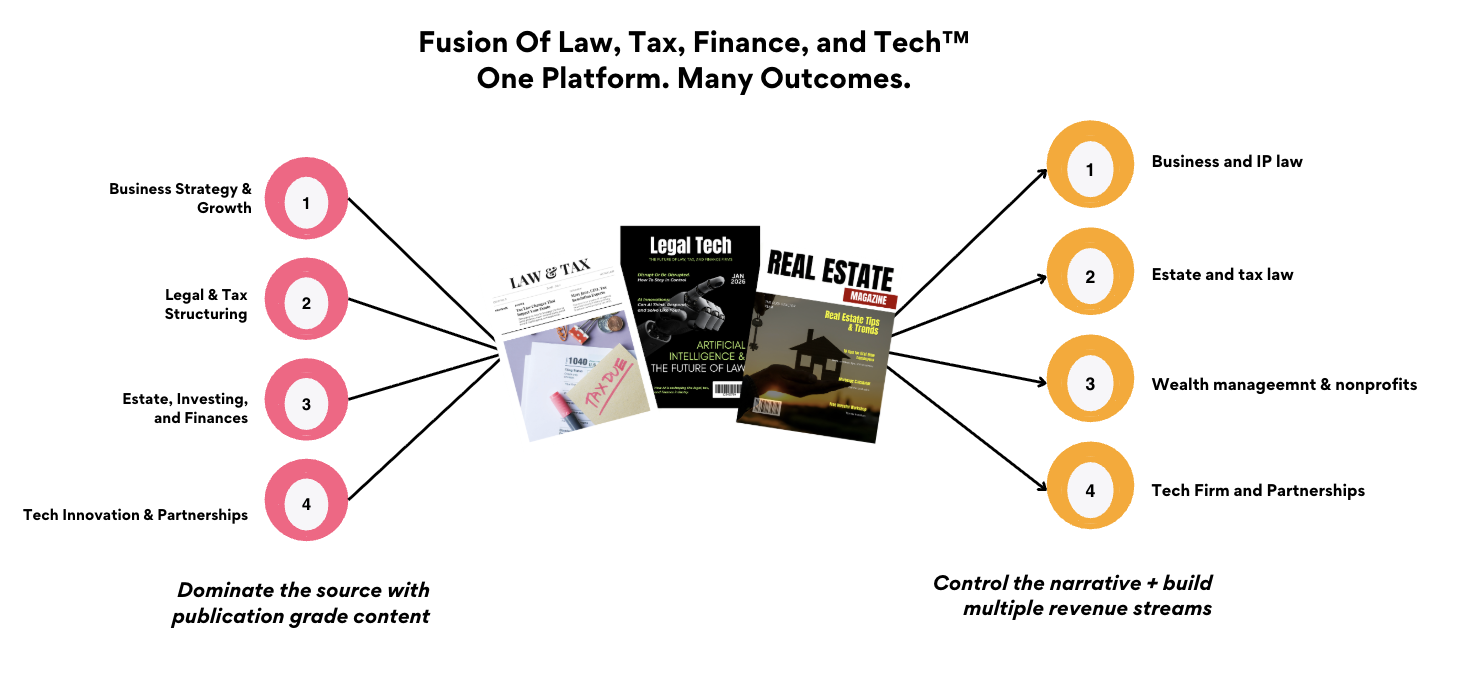

Authority & IP Incubator™

AI, IP, and Diversification

Designed to turn expertise into leverage, ownership, and reach.

AI & IP Incubator – convert knowledge into AI tools, systems, and assets

AI Tech & Vibe Coding – build apps that maximize time, talent, and treasure

Authority Engineering – speaking, writing, TEDx, magazines, and publications

Start A Magazine™ - trust, authority, keyword dominance, thought leadership, and AI and search indexing

Double Bottom Line Incubator™

Nonprofit & Foundation Fusion

Designed to align profit, purpose, and planet.

Strategic integration of public nonprofits for education, research, AI innovation, and grant acquisition

Alignment of private foundations for tax mitigation, asset protection, and corporate/family philanthropy

Alignment of impact investing & grant programs

Integrated with business, estate, and tax strategy - not isolated from it

Unlock social capital and partnerships with the government, corporations, and foundations

BENT Law Assessment™

We evaluate your situation through four integrated lenses:

• Business – structure, operations, and growth strategy

• Estate – asset protection, continuity, and transfer risk

• Nonprofit – eligibility, integration, and public-benefit leverage

• Tax – hidden layers, inefficiencies, and mitigation opportunities

This assessment connects law, tax, finance, and family legacy into one system.

From there, we:

• Identify gaps, traps, and misalignments

• Identify capital, tax, and ROI enhancements

• Create a centralized, end-to-end roadmap

You do not need to decide the path.

The assessment determines it.

All incubators route through the same intake.

We don’t sell services.

We install systems that compound.

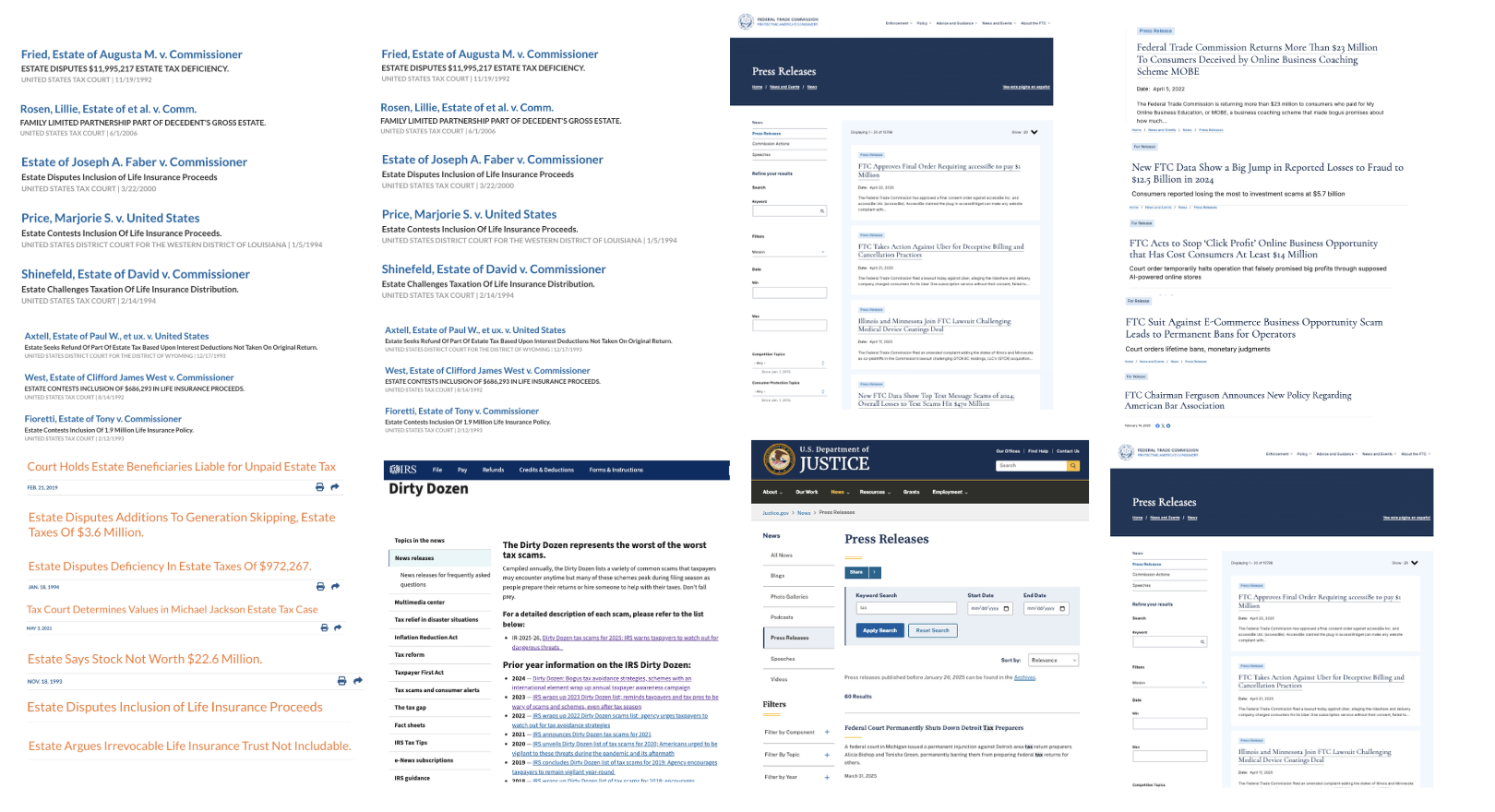

PROOF OF EXECUTION

For Those Who Prefer Bullets & Pictures Over Autobiographies

Individuals & Corporations

Built Through Real-World Execution

Two decades of cross-disciplinary integrations

Entities aligned across business, nonprofit, tech, and tax systems

Work spanning private, corporate, and public-benefit structures

AI innovations across law, tax, and finance concepts since 2015

10,000+ cases and clients served across different sectors

$20 billion in personal, corporate, business, and nonprofit assets restructured

Philanthropists & Impact Investors

Capital, Education, and Impact Redirected Across 100+ Industries & Sub-Industries:

$75 million in funding awarded for multiple education initiatives

Education, innovation, and public-service outcomes delivered

Ghostwriting applications, grants, and corporate documents for 500+ firms

Tax-exempt entities aligned with taxable entities across diverse sectors

500+ knowledge hubs, education centers, and innovation hubs launched

100+ million in IP and assets earmarked for social capital programs

Tech Incubators & Innovations

100+ Innovations & Technologies Introduced To The World Through Focused Tech Incubators™ since 2010:

Law, tax, finance, and philanthropy apps

Personal, business, and family friendly apps

IP creation, distribution, and monetization apps

Wealth generation, protection, and preservation apps

Business, estate, nonprofit, foundation, trusts, tax, and investment apps

Grant-fueled innovations and experiments with taxable and tax-exempt entities

AI technologies available for customization, installation, deployment, or cloned into your business - tailored to your unique needs.

What We Don’t Do

We don’t sell loopholes.

We don’t promote schemes.

We don’t push structures that collapse under scrutiny.

We don't offer passive or get-rich-quick tactics.

We don't offer any "AI earnings" guarantees.

We actually dedunk those concepts and educate readers through our magazines and publications - found in the tab.

There is NO one-case-fits-all situation.

Every case is different.

Everything we design is education-first, compliance-driven, evidence-backed, and built to last.

Start With A 100% Complimentary & Pro Bono Strategic Assessment

No Pressure. No Hard Sales. No Arm Twisting.

We Don't Sell Services - We Architecture & Install Systems That Are Designed To Last Forever.

Fill The Form Below

100% Confidential and Private

Schedule A Call To Explore Alignment

FOLLOW US

COMPANY

LEGAL

Copyright © 2026. All Rights Reserved c/o Law and Tax Foundation™ and Become A Philanthropist™