STRATEGIC PHILANTHROPY

Capital Allocation for Long-Term Impact, Resilience, and Growth

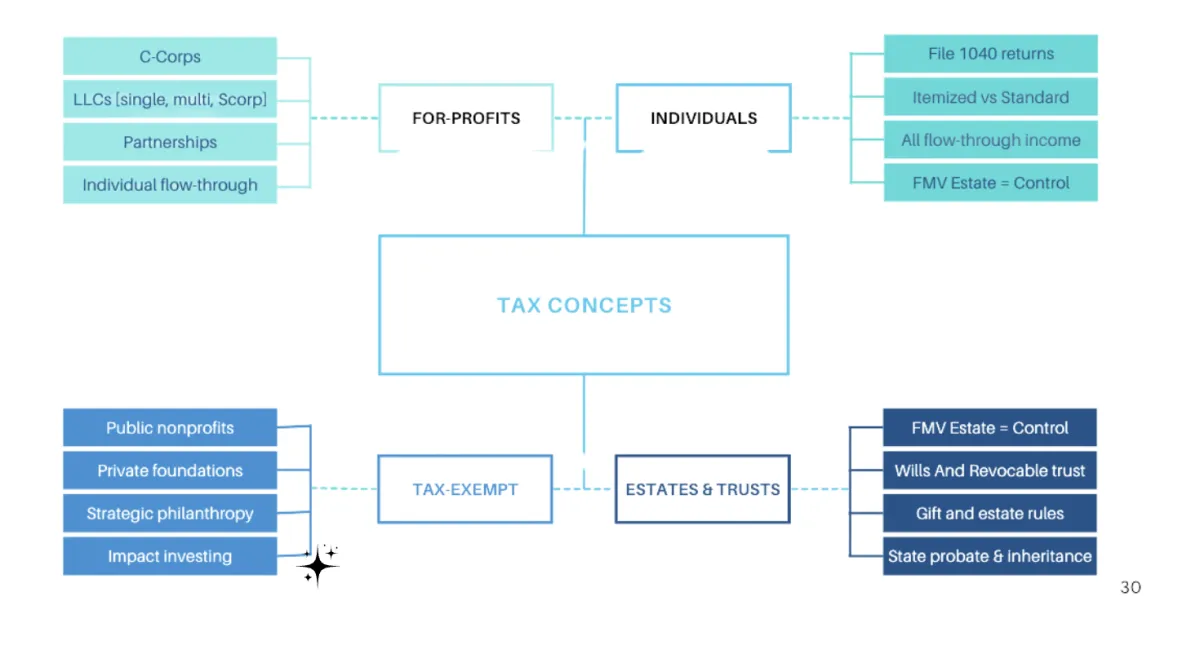

Strategic philanthropy is the intentional use of nonprofit and tax-exempt infrastructure to align capital, education, innovation, and public benefit with long-term business, estate, and tax strategy.

It is not charity in isolation.

It is structure, planning, and stewardship.

WHAT STRATEGIC PHILANTHROPY REALLY IS

Most people think philanthropy means writing checks or making donations.

In reality, strategic philanthropy is how governments, corporations, and long-term institutions allocate capital, fund innovation, and sustain public benefit over decades.

It uses legally recognized nonprofit and foundation structures to:

deploy excess capital responsibly

fund education and research

support innovation and experimentation

align public benefit with private enterprise

preserve resources across generations

Why This Matters

The U.S. tax and legal system was designed with both taxable and tax-exempt entities working together. Yet most individuals and businesses operate only on the taxable side of the system.

This leads to:

unnecessary tax exposure

limited access to institutional funding

overreliance on savings or debt

missed opportunities for impact and growth

audits, loopholes, scams, and probate

Strategic philanthropy bridges that gap - and is the preferred operating model for wealthy entrepreneurs and families. The code loves philanthropists and incentivizes us to participate in the system.

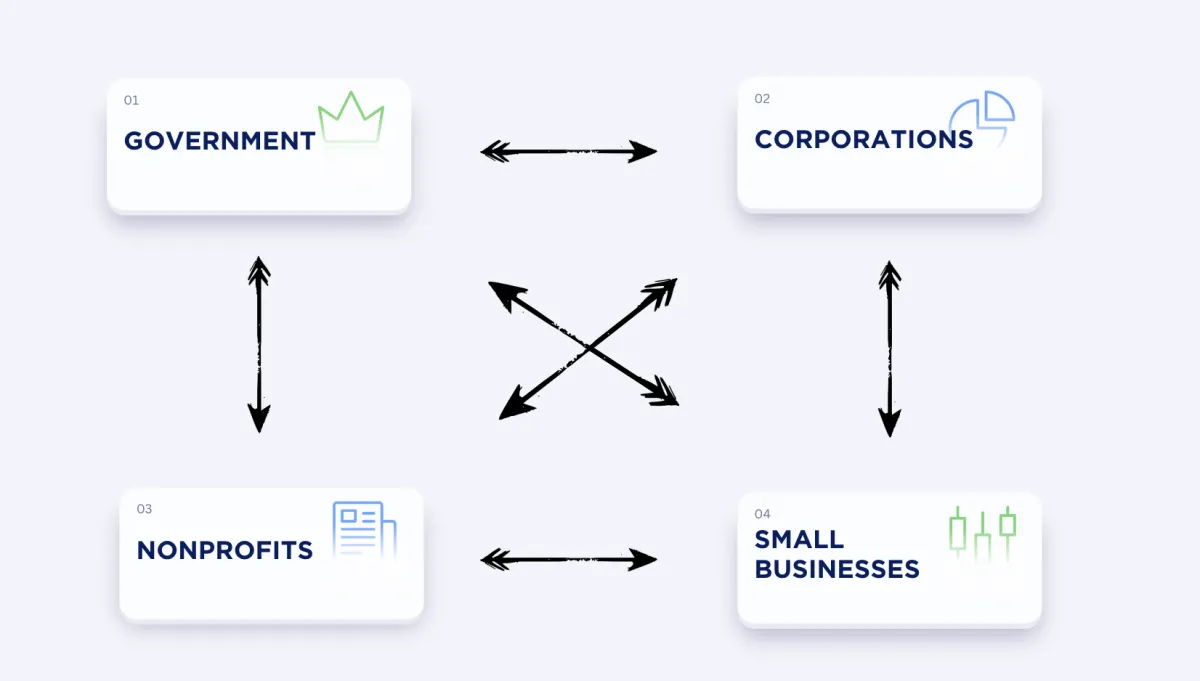

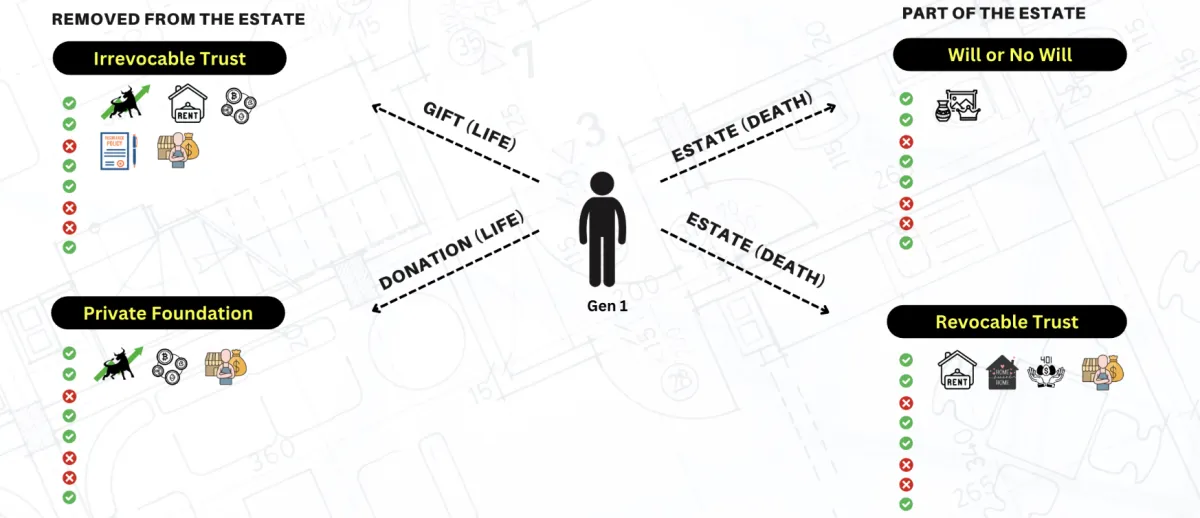

How Capital Actually Moves

Across the U.S. economy:

governments distribute hundreds of billions in grants and programs

corporations donate and invest billions through foundations and CSR initiatives

nonprofits serve as execution vehicles for education, research, and public service

businesses generate income and reinvest in growth

These systems are designed to work together.

Strategic philanthropy aligns them.

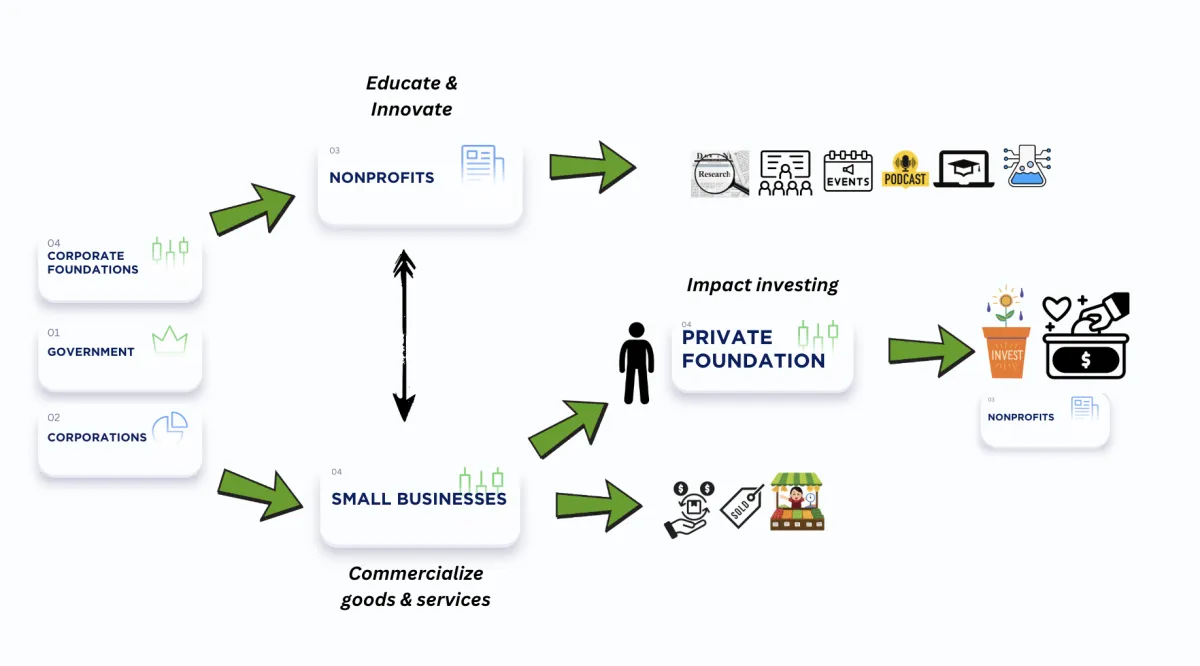

The Strategic Role of Nonprofits and Foundations In This Framework

Nonprofits and private foundations are not side projects.

They are federally recognized infrastructure used to:

manage and deploy capital

fund long-term initiatives

separate risk from operations

support education and innovation

build credibility and trust

control and own intellectual property

bypass gifting and estate tax limits

When structured correctly, they strengthen business strategy, estate planning, and tax efficiency rather than complicate it. This becomes especially important as your wealth profile passes the gift and estate tax exemption limits.

Our Approach

Law & Tax™ approaches philanthropy as part of a larger system.

We evaluate strategy using a Business, Estate, Nonprofit, and Tax framework to ensure alignment across all areas. We examine multiple layers of taxes and costs and simulate various scenarios.

This is not about selling entities.

It is about designing and architecting infrastructure that fits the full picture - designed to last across multiple generations.

STRATEGIC PHILANTHROPY IS NOT FOR EVERYONE

A Note on Fit

Strategic philanthropy requires:

a long-term mindset

a commitment to public benefit

respect for legal and regulatory boundaries

thoughtful planning and execution

It is not a shortcut.

It is not a loophole.

It is not a scheme.

It is not a tax shelter.

When done properly, it creates resilience, impact, and sustainability.

Frequently Asked Questions

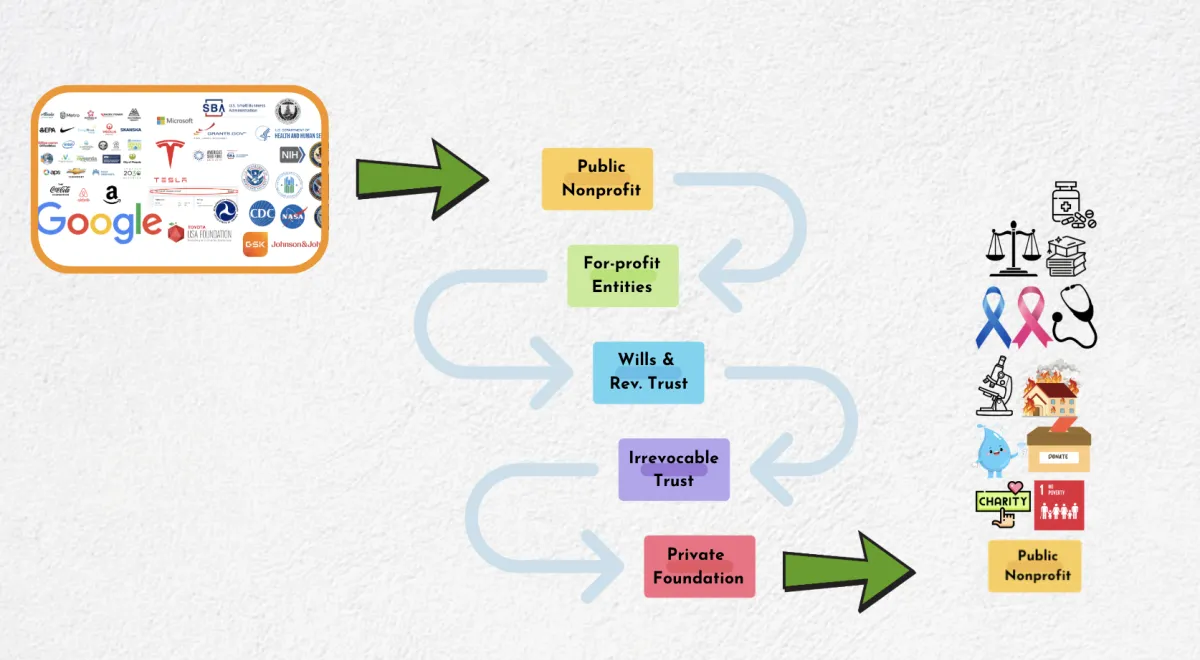

What is the difference between a public nonprofit and a private foundation?

Public nonprofits are typically funded by donations, grants, and public support.

Private foundations are usually funded by an individual, family, or corporation and have more control over how funds are distributed.

Are foundations only for wealthy individuals or large corporations?

No. Foundations are used by individuals, families, businesses, and organizations at many levels. The right structure depends on goals, complexity, and long-term intent.

How do foundations fit into tax and estate planning?

Foundations can be used to support long-term giving, reduce certain tax exposures, and strengthen estate and legacy planning when structured correctly.

Can a nonprofit or foundation work alongside a business?

Yes. Many businesses use foundations to support education, research, innovation, and public benefit initiatives while keeping operations separate.

Do foundations give grants only to nonprofits?

Foundations typically fund public nonprofits, programs, and initiatives aligned with their mission. They do not operate like personal bank accounts.

Is this a loophole or tax shelter?

No. Foundations are regulated entities with clear rules, reporting requirements, and compliance obligations. Strategic philanthropy is about structure and stewardship, not shortcuts.

Do I need to know which structure I need before applying?

No. The strategic assessment determines whether a public nonprofit, private foundation, or other structure is appropriate.

What is the first step if I am interested?

The first step is a structured strategic assessment to understand goals, complexity, and alignment across business, estate, nonprofit, and tax considerations.

Hundreds of articles, keynotes, presentations, media features, and talks delivered on the strategic integration of nonprofits and foundations.

Supporting partners and associations that we routinely partner with, acquire funding and grants from, and work on social impact in a joint manner.

A small glimpse of purpose-driven educators, innovators, and entrepreneurs who have integrated nonprofits, foundations, or Mini Family Office™ strategic integrations across 100+ industries

A glimpse of nonprofits, foundations, and public benefit organizations that we've structured in all sorts of industries, covering A - Y (we have not structured a zoo yet).

A glimpse of educational magazines and publications that we're launching or launched with strategic experts and partners, like you.

NEXT STEP

Start With a Strategic Assessment

Every strategic philanthropy structure begins with understanding goals, complexity, and alignment.

The first step is a structured assessment to determine whether and how philanthropic infrastructure fits into the broader strategy.

Then, book a call to discuss your goals and explore a mutual fit.

FOLLOW US

COMPANY

LEGAL

Copyright © 2026. All Rights Reserved c/o Law and Tax Foundation™ and Become A Philanthropist™