Private Foundations (501(c)(3))

Capital Allocation Infrastructure for Long-Term Public Benefit

Private foundations are federally recognized, tax-exempt entities designed to allocate capital for charitable, educational, scientific, and humanitarian purposes. They serve as the primary mechanism through which excess income, assets, and investment capital are governed, deployed, and recycled for long-term impact within the U.S. tax-exempt system.

Role Within the U.S. Philanthropic Framework

In the United States, private foundations:

Are typically funded by individuals, families, corporations, or institutions

Are required to distribute a minimum of 5% of assets annually

Operate under strict self-dealing, reporting, and governance rules

May engage in grantmaking and program-related investments

Private foundations are not discretionary vehicles.

They are regulated capital-deployment structures.

Strategic Function of Private Foundations

When properly designed, private foundations function as:

Long-term capital allocation vehicles

Charitable investment and grantmaking platforms

Legacy and continuity structures

Institutional funding partners for public nonprofits

The modern private foundation framework in the United States emerged from early industrial-era debates on capital stewardship, governance, and public benefit.

Role Within the Matching Framework

Within the Become a Philanthropist framework, private foundations function as capital sources.

The Institute provides structural coordination to support lawful, mission-aligned deployment of foundation capital, including:

Compliance-first foundation formation and operational alignment

Strategic matching between foundations and qualified public nonprofits

Grantmaking frameworks aligned with mission, geography, and public-benefit objectives

Alignment of legal, tax, banking, investment, and fiduciary strategies, concepts, and professionals

Planning support for exits, liquidations, assignments, bequests, and intellectual property transfers

Governance continuity, including multi-generational board succession

Stewardship guidance for trustees and foundation leadership

The Institute does not acquire ownership, equity, or control over foundation assets, investments, or grantmaking decisions.

Structural Integrity & Compliance

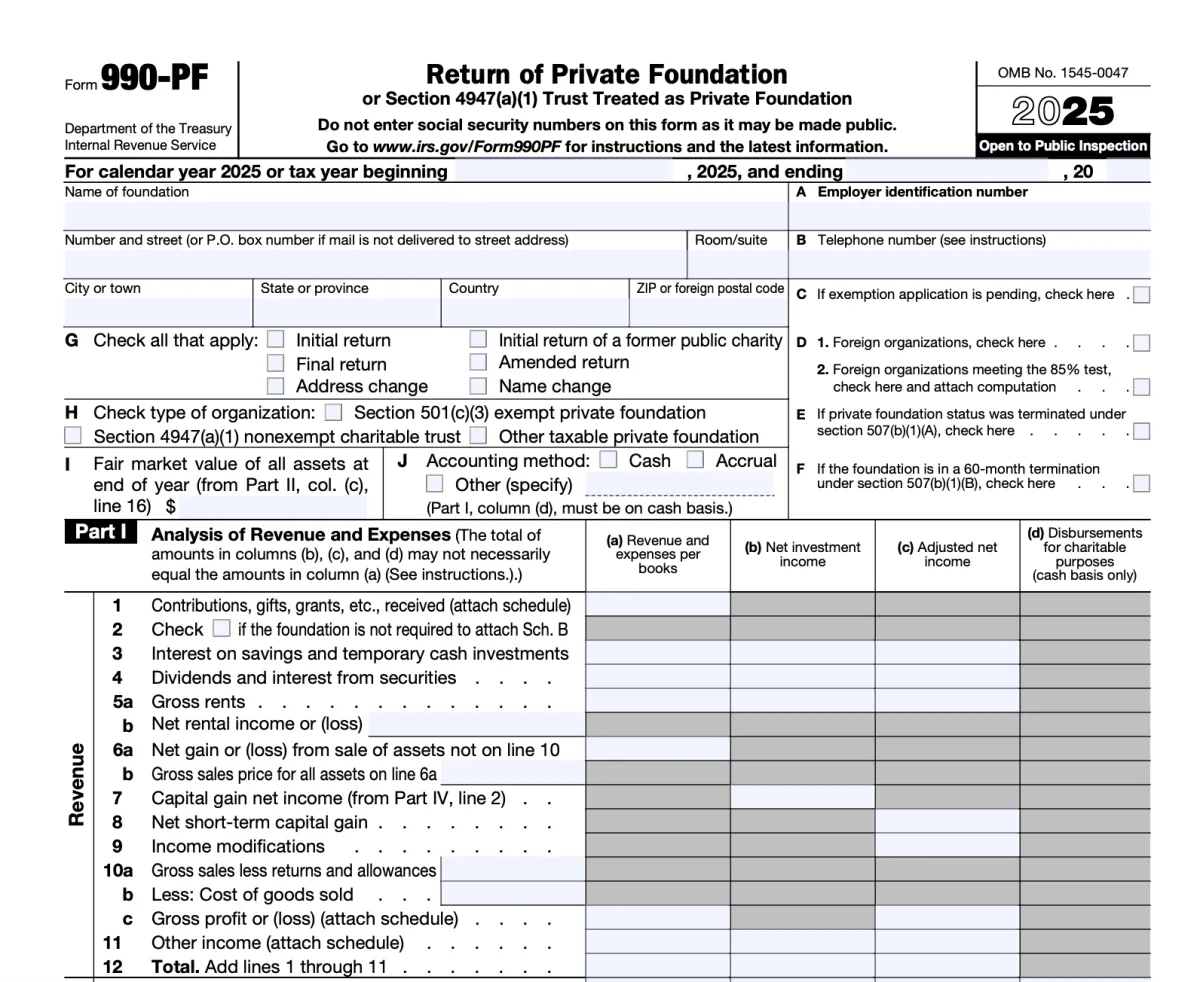

Private foundations operate within a defined statutory and regulatory framework and are subject to heightened oversight, including:

Prohibition of self-dealing and private inurement

Annual charitable distribution requirements

Excise tax on net investment income

Ongoing reporting and public disclosure obligations

Proper design, governance, and administration are essential to ensure compliance, preserve institutional credibility, and avoid regulatory or reputational exposure.

Illustrative excerpt from IRS Form 990-PF (Return of Private Foundation), demonstrating required public reporting and disclosure obligations.

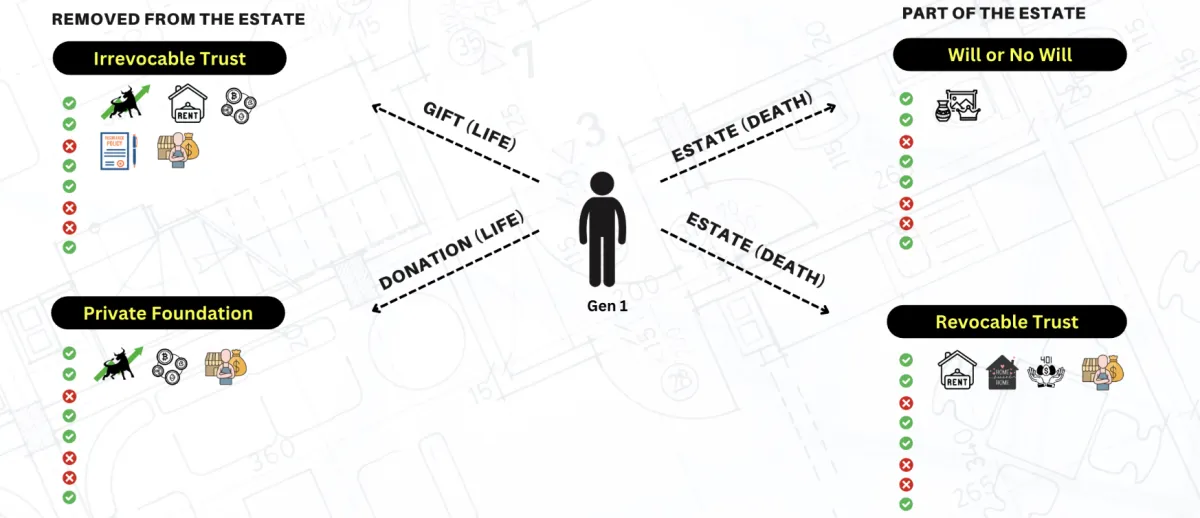

Integration With Broader Planning

Private foundations are most effective when coordinated with broader legal and financial structures, including:

Business entity structures

Intellectual property ownership

Investment strategies

Estate and succession planning

Family governance frameworks

This coordination promotes consistency across legal, tax, financial, and philanthropic decision-making and reduces fragmentation across entities and generations.

When Exploration Is Appropriate

Exploration of a private foundation structure may be appropriate for:

Individuals or families with sustained excess income or assets

Families training the next generation of leaders

Business owners approaching liquidity or exit events

Corporations with ongoing charitable deployment obligations

Institutions seeking long-term philanthropic governance

Investors exploring alternative liquidation strategies

Participation begins with an application and eligibility review.

Explore Participation

If you are evaluating the role of a private foundation within a broader philanthropic or capital-allocation strategy, you may apply to explore participation through the Institute.

FOLLOW US

COMPANY

LEGAL

Copyright © 2025. Nonprofits And Foundations c/o Estate Law Training Center. All Rights Reserved.